How to capture donor trends – and why that’s important

February 6, 2019

Your Voice: What the growth of charitable foundations means for fundraising

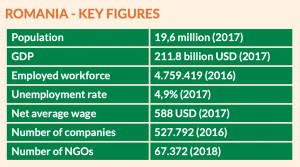

February 6, 2019Charitable giving is seeing rapid growth in Romania, but new legislation could hamper this in the future, according to the body that developed the national infrastructure for regular giving and text giving, Association for Community Relations (ARC Romania).

Lev Fejes, head of research at ARC Romania, says:

“Romanians’ philanthropic behaviour has gone through an impressive change in the past few years. While the public has a long history of donating to religious institutions, giving to NGOs is a relatively recent and important shift. We’ve seen a significant increase in individual donations to NGOs.”

Increase in charitable giving

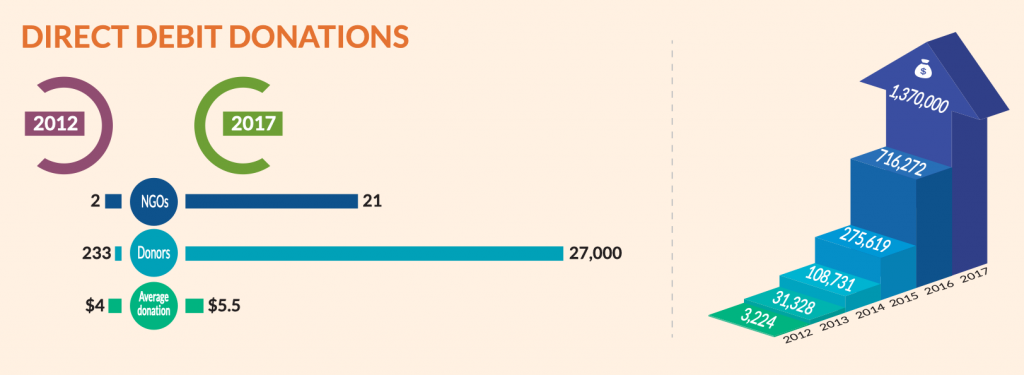

Since ARC Romania first introduced a system for direct debit giving in 2012, there has been major growth in the channel, from USD $3,224 (roughly €2,800) in 2012 to $2 million (€1.75m) in 2018. 2012 saw just 233 individual donors give to two NGOs, while in 2018, 22 NGOs collected $2 million from 50,700 donors.

The average monthly gift size is also growing, from $4 (€3.5) in 2012 to $5.6 (€4.9) in 2018, with an attrition rate of less than 8% in the first year of donation.

Source: ARC Romania

Text giving has also proven a successful fundraising channel. Romania was the third European country to implement a regular giving text programme, enabling individual supporters to give two-four Euros a month to a charity.

Reasons for growth in philanthropy

Source: ARC Romania

According to ARC Romania, while the recent introduction of regular giving infrastructure and online giving platforms have had a large part to play in encouraging philanthropy, powerful communications and fundraising campaigns from NGOs themselves are also inspiring the public to give. The independent media have also provided an key service in making individuals more aware of the importance of the sector and the value of a long-term or monthly donation.

Camelia Mates, ARC donation mechanism coordinator says:

“The efforts made by these different players have managed to create, in an admirable way, a sense of belonging to a community. People see in these organisations a reliable partner who will deliver on their promise and do what the state wasn’t capable of doing. Not only do people donate, but many have become volunteers or are even organising their own fundraising campaigns online.”

Community foundations & corporate giving

Community foundations are on the rise: first appearing in 2008 and now 16 across Romania. Between 2008 and 2016, community foundations invested $3.9 million (€3.4m) in their local communities through grants, scholarships, community projects, and in kind donations. Overall, community foundations have raised $4.3 million locally, from individual donors and small companies.

Corporate giving is also growing, with businesses able to direct 20% of their profit tax to non-governmental organisations, providing this amount is within 0.5% of their turnover. ANAF (National Authority of Fiscal Administration) figures show that in 2017, 27,784 businesses reported sponsorship expenses (including private scholarships), amounting to over 1.27 billion RON (EUR 280 million).

Although this amount is significant, this tax incentive is under-utilised, and it could bring twice as much money to the NGO sector, if all eligible companies were to use the scheme. In addition, recent legislative changes has caused some confusion and there is uncertainty as to whether corporate giving will continue to grow.

Legislative changes

Concerns have been raised that recent legislative changes will affect giving from both individual and corporate giving. One such change, introduced at the start of 2019, allows individuals to redirect 3.5% of their income tax versus the previous 2%. While this appears to be an increase, it is only those NGOs accredited with at least one licensed social service that can benefit from such donations, rather than the full spectrum of charitable bodies.

A civil society advocacy programme has successfully lobbied for the tax scheme to be amended to include all NGOs and this will be implemented from the start of 2020, however only those NGOs that provide licensed social services can benefit from the higher rate of 3.5%. ARC Romania cautions that, as a result of the tax changes, the majority of NGOs will raise considerably less funds through this fiscal facility in 2019.

Additionally, to qualify for corporate sponsorship, organisations must now feature in a national register, which has been slow to implement, hindering fundraising efforts. A law requiring all NGOs operating in Romania to publish the full names of the “real beneficiaries” of their services and donations, will soon enter in force, which ARC says is “likely to cause problems.”

ARC Romania states: “The latest political and economic developments in Central and Eastern Europe demonstrates that Romania needs a powerful civil society, now more than ever. ARC has successfully developed the infrastructure for large numbers of small and local donors to get involved in civic causes and to have ownership on the positive changes they want to see in their country, but there is a need for financial growth and stabilisation, empowerment and professionalisation, in order to have the significant and long-term impact we envision.”