Your Voice: Overcoming the barriers to cross-border giving

May 16, 2018

How to tell a story that will inspire global audiences

May 16, 2018The potential for using blockchain technology to improve cross-border giving is huge, but there are some major challenges still to be overcome. Rhodri Davies, head of policy at Charities Aid Foundation and leader of Giving Thought, explores the potential for using it to enable cross-border giving.

You may well have heard of blockchain technology – most likely as the thing that makes cryptocurrencies like Bitcoin possible. However, there is growing awareness that the technology has far wider potential applications.

That is why tech companies, banks and governments around the world are piling money into experimenting with blockchain in everything from supply chain management to voting systems. And the technology also has profound implications for civil society and philanthropy, as we have been exploring at CAF for the last few years.

Explaining blockchain

In short, a blockchain is a distributed public ledger: a way of keeping a record of transactions and ownership within a system without the need for a traditional trusted third party. (In reality things are slightly more complicated- for instance there is growing disagreement between those who believe blockchains must be entirely public and those who want to create private or ‘permissioned’ ledgers- but we can gloss over that for now).

Let’s focus on the key features of the technology and what they enable. In the context of cross-border giving ─ at least in the short term – the main impact is likely to come from three things: disintermediation, non-geographic transactions and radical transparency.

Removing the need for middlemen

A public ledger on which entries are immutable (i.e. cannot be altered after the fact) gives users a trusted shared record to work with. It is then possible to build self-executing computer protocols known as ‘smart contracts’ on top of this which can perform set functions when certain criteria are met (i.e. “If X happens, then do Y”). This creates a disintermediating framework in which you can have trustworthy transactions without the need for a third party, enabling the removal of many traditional middlemen.

Non-geographic transactions

The fact that blockchains are distributed (i.e. they are spread across all users of the system and not kept in any one place) is also important, as this means that they are not tied to any particular geographic location.

Combined with the removal of intermediaries, reducing associated legal and banking costs, this could significantly reduce the cost of cross-border giving. If it is possible to transfer financial value using a distributed framework that is not tied to a particular country, this could avoid the FX costs that currently make up such a large proportion of the expense of moving money internationally. It could also make it easier to get money into parts of the world where traditional financial infrastructure is lacking or undermined by corruption.

Radical transparency

The other major implication of blockchain technology is radical transparency. The ability to create unique and non-fungible units, when combined with the public nature of the ledger, means that assets can be tracked through a chain of transactions. When it comes to philanthropy, this means that a donor might be able to trace their individual gift all the way through a recipient charity and see exactly how it is spent.

This could help reduce fraud and corruption, making donors and funders more confident that their money was being spent effectively. But it could also pose a significant challenge in contexts where keeping the identity of donors or beneficiaries hidden is justifiable and necessary. For instance, a funder supporting gay rights advocacy in a country where homosexuality is illegal would need to ensure that by using a blockchain-based platform they weren’t inadvertently publicising the identity of organisations or individuals receiving grants, and thus putting them in danger of imprisonment.

Putting blockchain into practice

The idea of using blockchain for cross-border giving is already being tested. Large INGOs and aid agencies like UNICEF and the World Food Programme are experimenting with using blockchain for their internal money flows. Meanwhile, start-ups like Disberse are trying to build platforms that can harness blockchain technology to make cross-border payments more efficient, transparent and cost-effective.

These efforts face a number of challenges. There is still little clarity about the regulation of blockchain or cryptocurrency, and regulators and governments around the world are taking widely differing views of the technology. There is also a significant ‘last mile’ problem: even if you move money on a blockchain, you will reach a point where you need to spend it on goods and services on the ground. Unless you can spend cryptocurrency directly, or have some way of turning your blockchain-based token back into real money, it is not much use. This may change in the future if the technology becomes more widespread, but for now it remains a big challenge.

The potential for using blockchain technology to improve cross-border giving is huge. But there are also a number of big challenges that need to be overcome. We need to find ways to bring funders and NGOs together with the tech sector to identify meaningful use cases where blockchain could bring real benefit, and find solutions to some of the challenges. Only then will we have a chance of realising the technology’s true potential for cross-border giving.

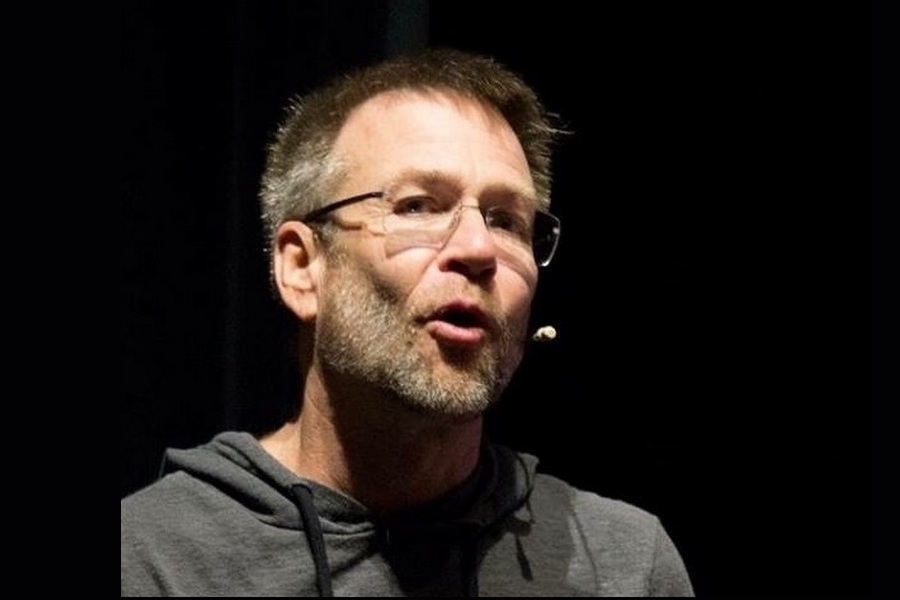

About Rhodri Davies

Head of policy at Charities Aid Foundation (CAF), Rhodri leads Giving Thought, – CAF’s in-house think tank focusing on current and future issues affecting philanthropy and civil society. He is the author of Public Good by Private Means: How philanthropy shapes Britain, which traces the history of philanthropy in Britain and what it tells us about the role of modern philanthropy. Beyond that, he has researched, written and presented on a wide range of topics – from social investment to the charitable applications of cutting-edge technologies such as artificial intelligence and blockchain – and is much in demand as an adviser to governments, businesses, charities and philanthropists.