Yaële Aferiat: What we learned from taking the French fundraising conference online

August 5, 2020

Where now for corporate fundraising?

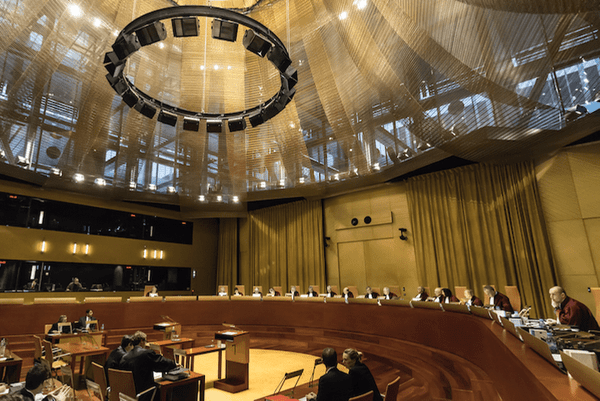

September 9, 2020Image: Court of Justice of the European Union

Following the European Court of Justice’s landmark ruling that Hungary’s foreign funding restrictions are unlawful, our public affairs columnist Patrick Gibbels explores the implications for other nations considering imposing similar restrictions.

The July edition of Fundraising Europe touched upon two important themes for the philanthropy sector; Anti Money Laundering and Terrorism Financing and the rule of law in certain European Member States. In a landmark case, the European Court of Justice has ruled that restrictions on foreign funding by Hungary, which requires organisations receiving over 20,000 EUR in foreign funding to register as ‘foreign-funded entities’, are unlawful according to EU Law.

But, the story doesn’t stop there. The conclusions by the Council of the EU, regarding the EU’s recovery plan and Multi-annual Financial Framework (MFF) includes a mechanism which would make it possible to block allocation of funds to countries that do not respect the rule-of-law. This should disincentivise governments from imposing restrictions on foreign funding, such as mentioned above. However, this mechanism is still undefined and needs to be supported unanimously at Council level.

The Hungarian government remains under fire as European Commissioner Vera Jourova (Czech) condemned the recent firing of the editor-in-chief of Index, which is deemed as one of the few independent Hungarian media outlets. Szabolcs Dull was sacked under tremendous government pressure, which consequently led to 80 journalists resigning in protest of this ‘attack’ on the independence of Hungarian media.

A bill which closely resembles the Hungarian law is now being debated in the Bulgarian parliament. Civil society organisations are often vilified as ‘foreign agents’ which undermine Bulgarian values and day-to-day life through their agenda. Unsurprisingly, the bill also aims to undermine a newly elected “Civil Society Council” which has been critical of the government. This could become a trend as Poland has previously stated that it was considering tabling a similar law. All of this will of course negatively impact fundraising in those countries.

Anti Money Laundering and Terrorism Financing

In the latest developments regarding Anti Money Laundering and Terrorism Financing, Romania and Ireland have been ordered to pay the Commission a lump sum of 3,000,000 EUR and 2,000,000 EUR respectively for failing to transpose directive 2015/849 (Prevention of the use of the financial system for the purpose of money laundering or terrorist financing).

On a related note, earlier this month, the Commission published a Commission Staff Working Document on “Tax fraud and evasion – better cooperation between national tax authorities on exchanging information”. A key problem addressed in the document is the inefficiencies in the current EU framework regarding cooperation between tax administrations. The assumption is that improved cooperation may lead to increased tax compliance throughout the EU by Member States sharing intelligence.

Related articles: View from Brussels

Patrick Gibbels, Gibbels Public Affairs

Follow Patrick @GPA_Brussels